OVERVIEW

Within days of Donald Trump’s second term, the United States finds itself in a rapidly escalating trade war—this time with Colombia, a supposed ally. Trump’s decision to impose punitive tariffs in retaliation for Colombia’s refusal to accept a U.S. deportation flight is a textbook case of economic self-sabotage: it raises prices on everyday goods, sparks diplomatic hostility, and repeats the failures of earlier tariff disputes. Below is a comprehensive, fact-based breakdown of these actions—and a detailed explanation of why American families and businesses inevitably pay the price.

1. HOW THE TRADE WAR STARTED

Colombia Refuses a Deportation Flight

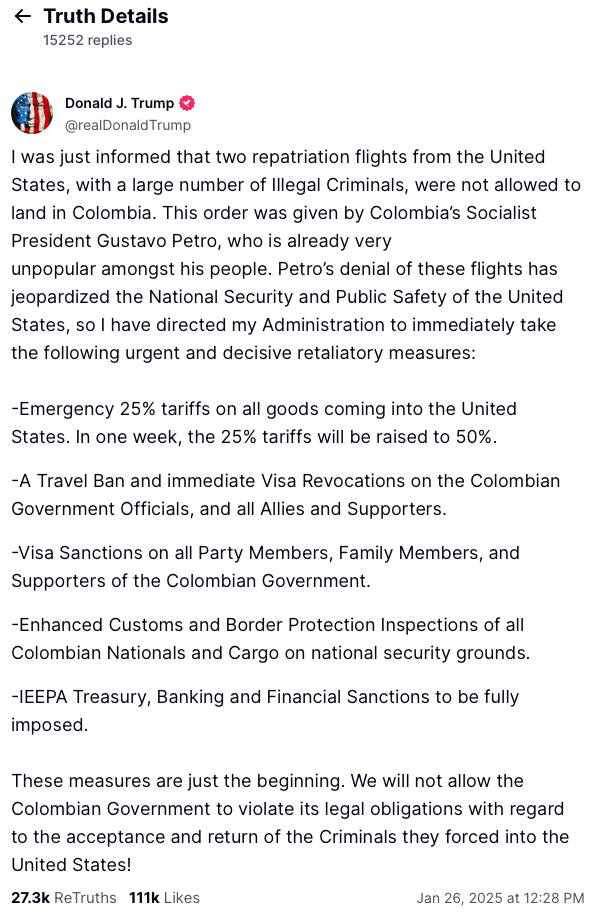

- Key Trigger: The Trump Administration tried to land a deportation flight in Colombia, but Colombian President Gustavo Petro denied entry.

- Trump’s Retaliation: In response, Trump announced a 25% tariff on all Colombian imports, threatening to raise it to 50% within a week. He also instituted travel bans, banking and financial sanctions, and mandatory inspections on Colombian goods.

Gustavo Petro’s Defiant Reply

- Petro openly criticized Trump on social media, affirming Colombia’s sovereignty and cultural pride, and vowing to respond with reciprocal tariffs on U.S. goods.

- Within days, both nations slid into a damaging trade conflict—showing how quickly bilateral disputes can morph into economic warfare.

2. ECONOMIC FALLOUT FOR THE UNITED STATES

Immediate Impact on Consumer Prices

- Tariffs on Essential Imports: Colombia is a key supplier of coffee, cut flowers, bananas, pineapples, avocados, and crude oil. When tariffs hit these products, American importers pay higher costs—leading to increased retail prices.

- Inflationary Pressure: As businesses see profit margins squeezed, they pass costs along to consumers. This cycle fuels higher grocery, gas, and event-planning bills, directly impacting working- and middle-class Americans.

Lessons from the 2018–2019 China Trade War

- Billions in New Taxes: Trump’s earlier tariffs on Chinese products effectively placed \$80+ billion worth of taxes on U.S. businesses, which then rippled through to consumers.

- Farmer Hardship: Tariffs triggered retaliation against American goods, obliterating key export markets. Taxpayer-funded subsidies tried to cushion the blow, but many farmers still struggled or went bankrupt.

- Unresolved Damage: Even after partial trade deals, supply chains and markets never fully recovered—proof that trade wars remain economically painful long after the headlines fade.

3. WHY AMERICANS END UP PAYING THE TARIFF: AN EXPANDED EXPLANATION

3.1 What a Tariff Really Is

A tariff is a tax placed on imported goods by the U.S. government. It’s collected by Customs and Border Protection (CBP) at the port of entry. Crucially, it’s the U.S. importer—an American company—that writes the check to the U.S. government, not the foreign exporter or government.

3.2 Who Writes the Check?

- Immediate Payer: The American company buying goods from Colombia must pay the tariff to clear customs.

- Mark-Up to Retailers: Once that cost is added, the importer raises prices when selling to wholesalers or retail outlets—who then factor in the higher cost on store shelves.

3.3 How Consumers Absorb the Cost

- Price Increases: From coffee beans to avocados, prices climb as the extra tariff cost moves down the supply chain.

- Inflationary Pressure: Multiple industries rely on imported raw materials or components. Tariffs on those inputs can drive up the final cost of countless products, fueling inflation across the board.

3.4 Debunking the “Foreigners Pay” Myth

- Misleading Political Rhetoric: Some politicians claim foreign producers “pay billions” in tariffs. In reality, the bulk of tariff revenue comes from American importers.

- Exporter Discounts: While foreign suppliers might cut prices slightly to retain market share, it rarely offsets the full tariff - especially when the tariff is in excess of 20%. For high-demand goods with few substitutes, most if not all of the new tax remains on U.S. businesses, and ultimately, on you.

3.5 Ripple Effects

- Reduced Spending: As costs rise, consumers cut back on purchases, which can slow economic growth.

- Retaliatory Tariffs: Foreign countries retaliate against U.S. goods—hurting American exporters, often in farming or manufacturing.

Conclusion: Tariffs function like a hidden tax that Americans pay for in higher consumer prices. Every coffee drinker, flower buyer, or home chef ends up subsidizing Trump’s politically motivated trade war.

4. DANGEROUS PRECEDENT FOR U.S. POLICY

Undermining Allies

- Colombia Is an Ally: Historically, the U.S. and Colombia have cooperated on security and counter-narcotics. Punitive tariffs erode that goodwill, creating an adversarial relationship instead.

- Diplomatic Ties at Risk: Canada has already hinted at retaliation if targeted similarly. Expect further alienation from allies if Trump continues to use tariffs as a bludgeon over unrelated disputes.

Domestic and Global Instability

- Fear and Uncertainty: Businesses require stable relationships to plan for supply chain costs. Constant threats of new tariffs destabilize markets, discouraging long-term investment.

- Escalation: When an ally retaliates, the White House may double down with even more tariffs, igniting a vicious cycle that hurts both sides.

5. AMERICANS BEAR THE BRUNT

The Hit to Household Budgets

- Daily Necessities Get Pricier: Coffee, cooking oils, fruits, and cut flowers face immediate cost hikes. Already-tight household budgets feel the pain.

- Inflation Driver: The Federal Reserve’s battle against inflation is undermined by new tariffs that stoke further price surges.

Pain for Small Businesses

- Higher Input Costs: Restaurants, food processors, and local flower shops operate on tight margins. Tariffs squeeze those margins, leaving businesses to either hike prices or risk closure.

- Potential Layoffs: When companies face higher costs and lower sales, they often cut payroll—leading to job losses in local communities.

6. WHY THIS ORDER IS FUNDAMENTALLY FLAWED

-

No Endgame in Sight

Without a diplomatic resolution plan, the administration’s knee-jerk reaction sets the stage for prolonged economic conflict. -

History Repeats Itself

The 2018–2019 trade war with China ended in higher consumer prices, billions in taxpayer-funded bailouts for farmers, and minimal concessions. -

Allies, Not Enemies

Colombia is not a hostile power. This trade war isolates the U.S. and needlessly sours a vital partnership in Latin America. -

Self-Imposed Tax

Tariffs functionally tax American importers and consumers—exactly the people Trump claims to champion. -

Ramping Up Global Tensions

The White House’s combative stance invites a new wave of retaliatory tariffs worldwide, weakening America’s global economic position.

7. BROADER IMPLICATIONS

More Trade Wars on the Horizon

- Canada and Others: Prime Minister Trudeau has already threatened proportional response if Canada is similarly targeted. A scattershot approach by the White House could incite multiple fronts of economic conflict.

Undermining U.S. Credibility

- Diplomatic Fallout: Allies no longer trust that the U.S. will abide by longstanding agreements. This can spill over into security and intelligence-sharing partnerships, reducing America’s strategic leverage.

Political Backlash

- Higher Living Costs: As more Americans feel tariff-induced price hikes, support for these measures is likely to erode.

- Industry Lobbying: Businesses battered by rising input costs may push Congress to challenge or curtail executive trade powers.

8. CONCLUSION

Trump’s tariffs on Colombia—sparked by a deportation dispute—are a classic demonstration of rash policy that punishes the very citizens it purports to defend. From the grocery aisle to the gas pump, Americans will inevitably shoulder the financial burden. Worse, this crisis inflames tensions with a critical ally in Latin America, setting a perilous precedent for future U.S. trade and diplomatic relations.

Bottom Line:

- Tariffs Are a Hidden Tax—collected on American soil from American businesses and passed on to American consumers.

- No Winners in a Trade War—only escalating prices, supply chain disruptions, and damaged alliances.

- Diplomacy Over Impulse—resolving disputes through negotiation, not punitive measures, is the only route that avoids clobbering household budgets and eroding America’s global standing.

Rather than projecting strength, this ill-considered trade conflict reveals how easily the U.S. can hobble its own economy under the guise of “retaliation.” History and basic economics prove that such trade wars conclude with more expensive goods, lost jobs, and zero meaningful concessions—except, perhaps, the concession of our own economic well-being.